Thousands of manufacturing and B2B businesses trust Invoteq for cutting-edge payment processing solutions and transformative payment technology.

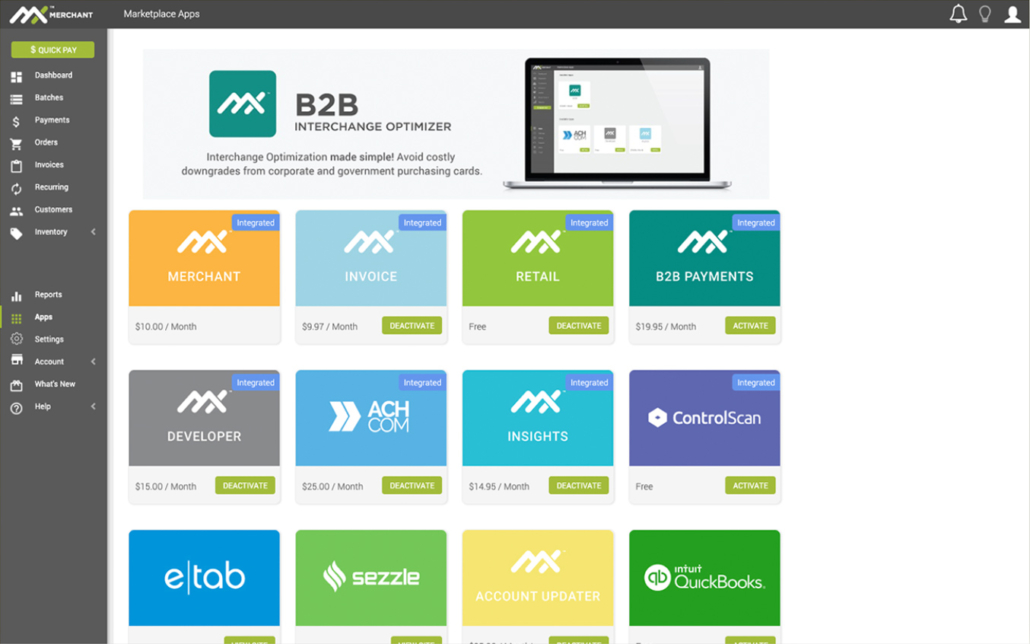

MX™ B2B optimizer works to help merchants receive an optimal Level 2 and Level 3 interchange rate for all purchasing and corporate cards.

When processing credit card payments, merchants incur interchange fees, which are costs charged by card issuers like Visa and Mastercard. These fees constitute a significant portion of the transaction costs, ranging between 70% and 90%. Depending on the detail level of the transaction data provided during processing, these fees can vary. Transactions are classified into three levels: Level 1, Level 2, and Level 3, with Level 1 attracting the highest rates and Level 3 the lowest.

Transaction Processing Levels Explained:

- Level 1 Processing involves capturing basic transaction data such as the payment amount and payment date.

- Level 2 Processing requires additional information, including applicable sales tax and a customer identifier.

- Level 3 Processing demands comprehensive transaction details, including over 20 fields such as tax ID, shipping ZIP code, freight amount, item description, quantity, and product code. This level is designed primarily for commercial card transactions.

Benefits of Higher-Level Processing: Offering detailed transaction data allows merchants to access lower interchange rates. By providing more comprehensive information at the time of payment authorization, transactions are authenticated more robustly, reducing the risk of disputes and thus qualifying for lower rates by the card brands. This reduction can reach up to 125 basis points.

Potential Savings: Businesses that process transactions with Level 2 and Level 3 data can benefit from significant savings. For example, typical interchange rates for card-not-present (CNP) corporate card transactions are approximately 2.7% at Level 1, decreasing to 2.5% at Level 2, and further reducing to 1.9% at Level 3. For high-value transactions that meet specific criteria, the rates can drop even further to 1.45%.

Implementing Level 3 Processing: Achieving Level 3 processing rates requires using a PCI-compliant payment gateway, as physical terminals cannot process transactions at this level. The gateway must accurately pass all required line-item details along with the transaction. A single missed detail can disqualify the transaction from Level 3 processing.

Utilizing a PCI-compliant payment gateway simplifies this process by automatically transferring stored invoice and line-item details from the system to the point-of-sale. This automation ensures that transactions are qualified at reduced interchange rates, minimizing the processing fees for the business and alleviating the merchant’s burden of manual data entry.

This structured approach to processing not only enhances transaction security but also optimizes cost efficiency, making it a strategic choice for businesses aiming to reduce their payment processing expenses.

Get Started Free

Fast setup. No long-term contract. Cancel anytime.